【能源与环境】 | Energy & Environment

By Casey Crownhart, MIT Technology Review,2024-02-12

Sales slowed in 2023, but heat pumps are gaining ground on fossil fuels.

STEPHANIE ARNETT/MITTR | ENVATO

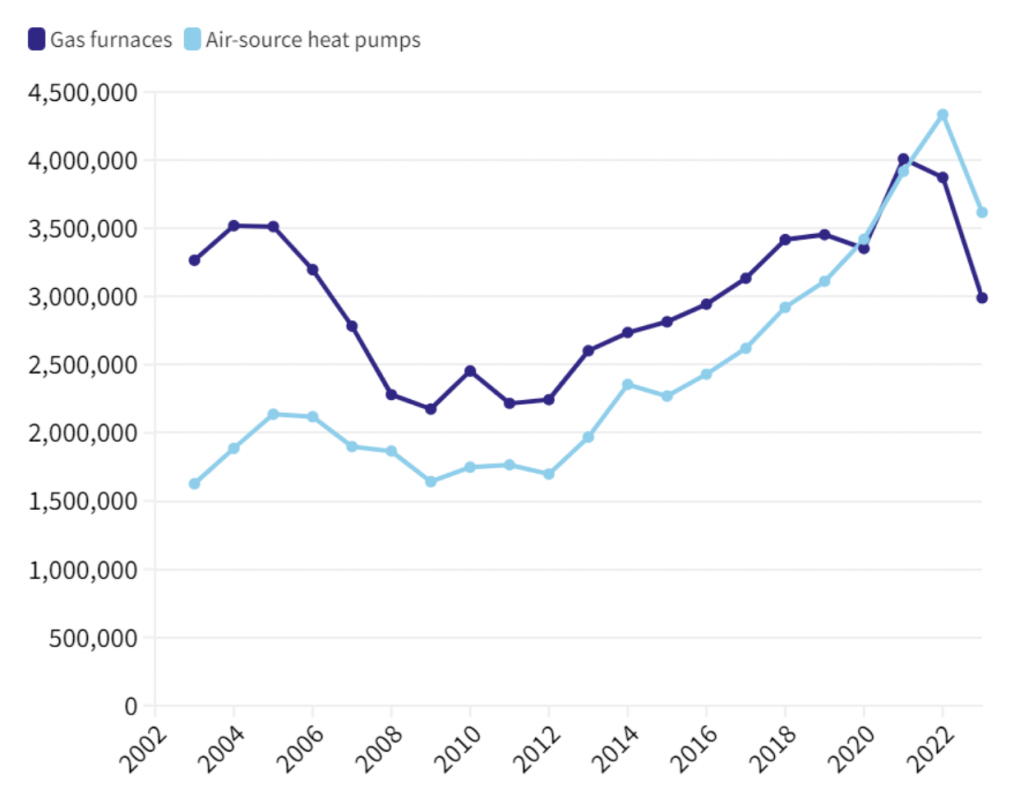

Heat pumps are still a hot technology, though sales in the US, one of the world’s largest markets, fell in 2023. Even with the drop, the appliances beat out gas furnaces for the second year in a row and saw their overall market share increase compared to furnaces, sales of which also fell last year.

Heat pumps heat and cool spaces using electricity, and they could be a major tool in the effort to cut greenhouse gas emissions. (About 10% of global emissions are generated from heating buildings.) Many homes and other buildings around the world use fossil fuels for heating in systems like gas furnaces—heat pumps are generally more efficient, and crucially, can be powered using renewable electricity. Experts say heat pump sales will need to grow quickly in order to keep buildings safe and comfortable while meeting climate goals.

Heat pumps have been around for decades, but the technology has been experiencing a clear moment in the sun in recent years, with global sales increasing by double digits in both 2021 and 2022, according to the International Energy Agency (IEA). Heat pumps were featured on MIT Technology Review’s 2024 list of 10 Breakthrough Technologies.

Sales fell by nearly 17% in 2023 in the US, one of the technology’s largest markets, according to new data from the Air-Conditioning, Heating, and Refrigeration Institute. The slowdown comes after nearly a decade of constant growth. The AHRI data isn’t comprehensive, but the organization includes manufacturers accounting for about 90% of the units sold in the US annually.

Annual US heat pump and gas furnace sales

However, the decline likely says less about heat pumps than it does about the whole HVAC sector, since gas furnaces and air conditioners saw even steeper drops. Gas furnace sales declined even more than heat pumps did in 2023, so heat pumps actually made up a slightly larger percentage of sales this year than in 2022.

The broad slowdown reflects broader consumer pessimism amid higher interest rates and inflation, says Yannick Monschauer, an analyst at the IEA, via email.

“We have also been observing slowing heat pump sales in other parts of the world for 2023,” Monschauer adds. In Europe, a rush to electrify, driven by the energy crisis and rising natural gas prices, has slowed.

New incentives programs could help speed progress in 2024 and beyond. The Inflation Reduction Act, a sweeping climate bill passed in 2022, includes individual tax credits for up to $2,000 towards a new heat pump, which went into effect at the beginning of 2023.

However, the more generous incentives in that law have yet to take effect, says Wael Kanj, a research associate at Rewiring America, a nonprofit group focused on electrification in the US.

New rebates set aside funding of up to $8,000 towards a new heat pump system for low- and middle-income households. Distributing the rebates is up to individual states, and analysts anticipate those programs getting up and running in late 2024, or early 2025, Kanj says.

Heat pumps are a crucial component of plans to combat climate change. In a scenario where the world reaches net-zero emissions by 2050, heat pumps need to account for 20% of global heating capacity by the end of this decade, according to an IEA analysis.

“The next five, ten, 15 years are really going to be important,” Kanj says. “We definitely need to pick up the pace.”

Reprinted from MIT Technology Review .

Ralated:

![[Recruiting 2011] Jointing.Media](http://jointings.org/eng/wp-content/themes/news-magazine-theme-640/cropper.php?src=/cn/wp-content/uploads/2012/06/123.png&h=50&w=50&zc=1&q=95)